| By Elisabeth Rosen |

Fragrance brands are notorious digital laggards. L2’s Digital IQ Index®: Beauty labels most companies in the sector as Challenged, reflecting widespread failure in areas from e-commerce to social media. But a new fragrance company, xSense, is challenging that trend.

The brand relies exclusively on digital platforms to sell and promote its three scents, which promise to enhance productivity in the office, workouts at the gym, and relaxation at bedtime. While xSense is establishing an active presence on Facebook and Instagram, consumers can only buy the fragrances on the xSense website. Ashok Gowda, who co-founded xSense in 2014, explained that the brand sells directly to consumers not only because it can move from manufacturing to sales in just a few weeks, but also because the website lets it tell the “brand story” more effectively than physical retailers or e-tailers like Amazon.

“Digital allows us greater control of our story, and the ability to quickly and efficiently target potential customers,” Gowda said.

By leveraging behavioral targeting on social platforms, xSense can market each of its products to the demographic most likely to be receptive. For example, the “Rest” scent is being marketed to “overbooked moms” who would welcome the chance to enhance their relaxation.

“We go beyond demographics such as urban moms with kids and add the kind of content they like, such as shopping discounts, which is highly correlated to busy moms,” he explained. “We can then serve content that shows how our products help you get through your day, from being on the go to resting when the kids are away.”

In addition to creating content, Gowda also plans to leverage UGC and paid influencers, who will share their own xSense success stories in pictures and short videos. While Cosmetics brands like Benefit and Smashbox have seen results from UGC, the strategy never really carried over to Fragrance. The few brands to embrace the strategy have found significant payoffs: Cacharel nearly doubled Facebook likes for its Amor Amor scent with a Valentine’s Day-themed UGC contest.

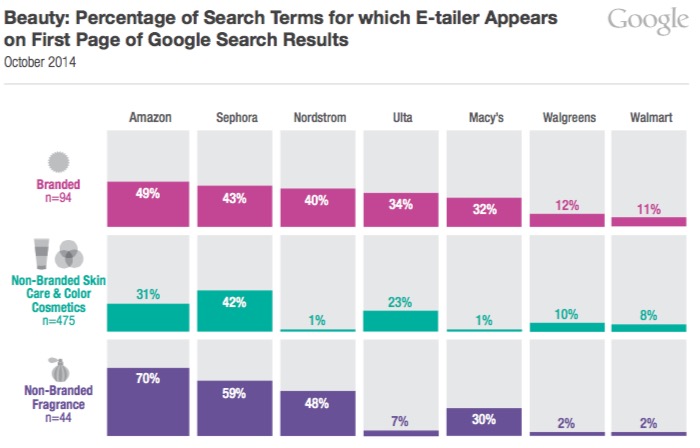

However, while digital makes it easier for xSense to promote its products, it also forces the brand site to compete for visibility with major e-tailers, which dominate top results in organic Fragrance searches. Amazon appears on the first page for 70% of non-branded Fragrance search terms and Sephora appears 59% of the time, according to L2’s Beauty Index. In comparison, the two e-tailers’ average visibilities across Skin Care and Color Cosmetics keywords barely crack 40%.